Detect non-compliant personal trades automatically as an advisor

Financial services firms have to spend a lot of time and resources to mitigate the legal and reputational risks that come with employee personal trading. TradeLog is personal account dealing software that helps you reduce the chance of market abuse by enforcing your company trading policy and automating trade pre-clearance.

Spend less time on trade reviews and speed up personal trading compliance as an issuer

Traditionally, trade pre-clearance and monitoring can be tedious, slow and error-prone. TradeLog is software to ensure personal account dealing compliance by reducing the administrative work related to employee trade reviews, ensuring adherence to your company policy and meeting all requirements of European and local legislation.

Accelerate the pre-clearance and monitoring of personal trades, ensuring compliance with MAR, MiFID II and local legislation.

Reclaim time

With TradeLog, you can send cumbersome spreadsheets and mail exchange into the past, simplify personal account dealing monitoring and pre-clearance, and enable compliance officers to focus on more strategic tasks.

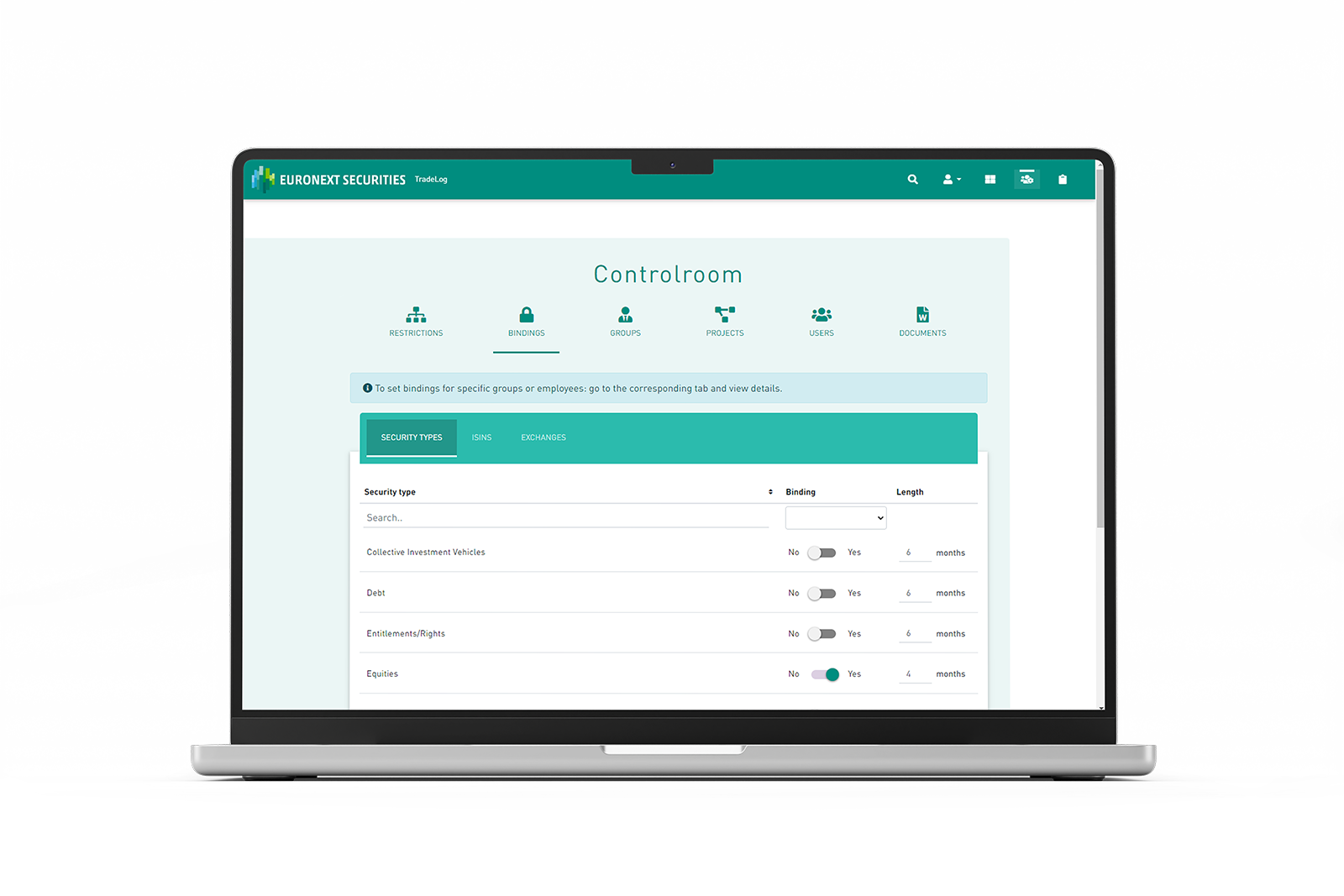

Take control

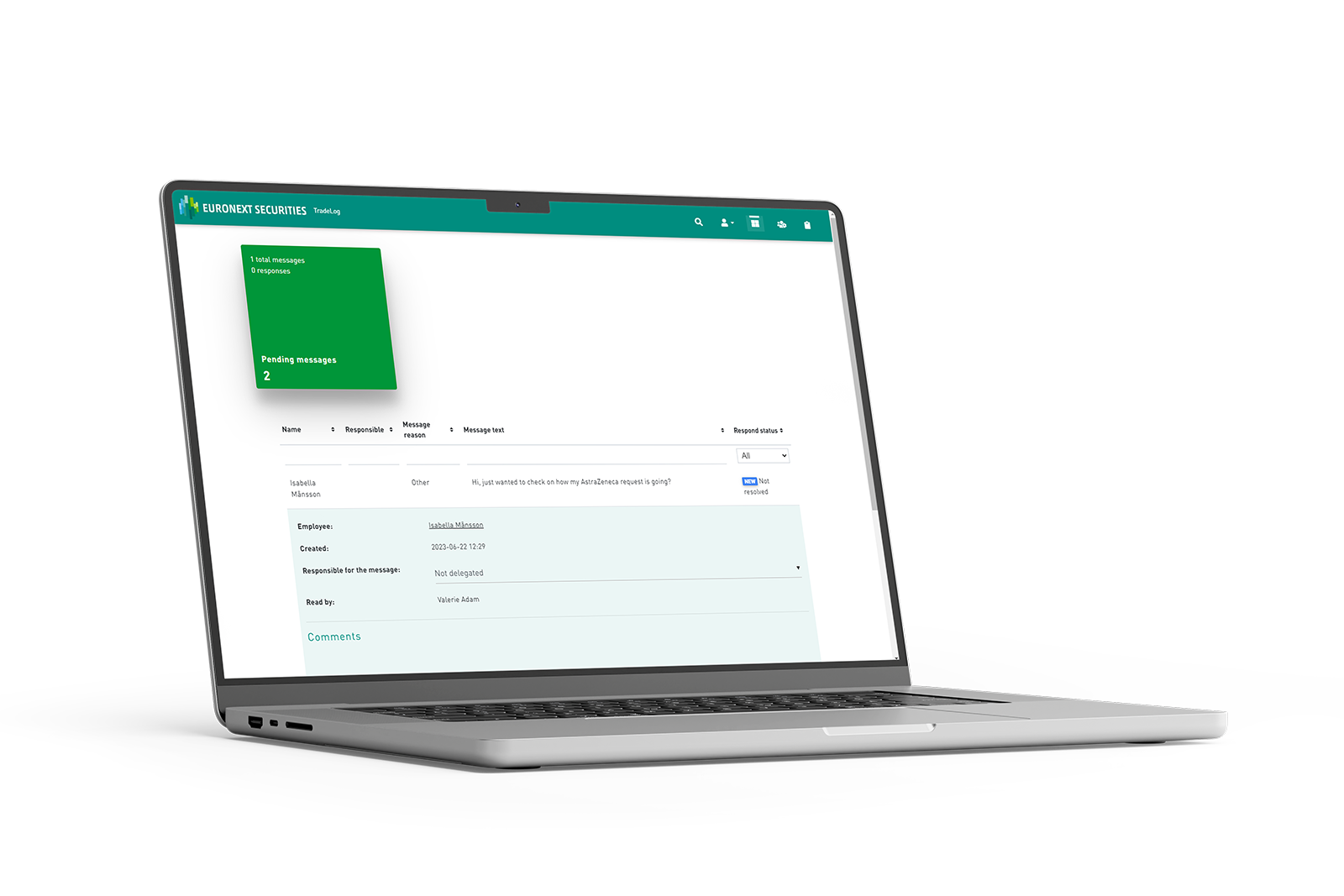

The platform is your single source of truth when it comes to personal account dealing compliance, giving you a comprehensive overview of each employee’s trade requests, holdings and attempted violations.

Improve transparency

TradeLog keeps track of all employee personal trades, approved and declined, enabling you to generate in no time standard and custom reports, such as violation logs and reports to authorities.

User-friendly digital personal account dealing monitoring software built to simplify your compliance workflow

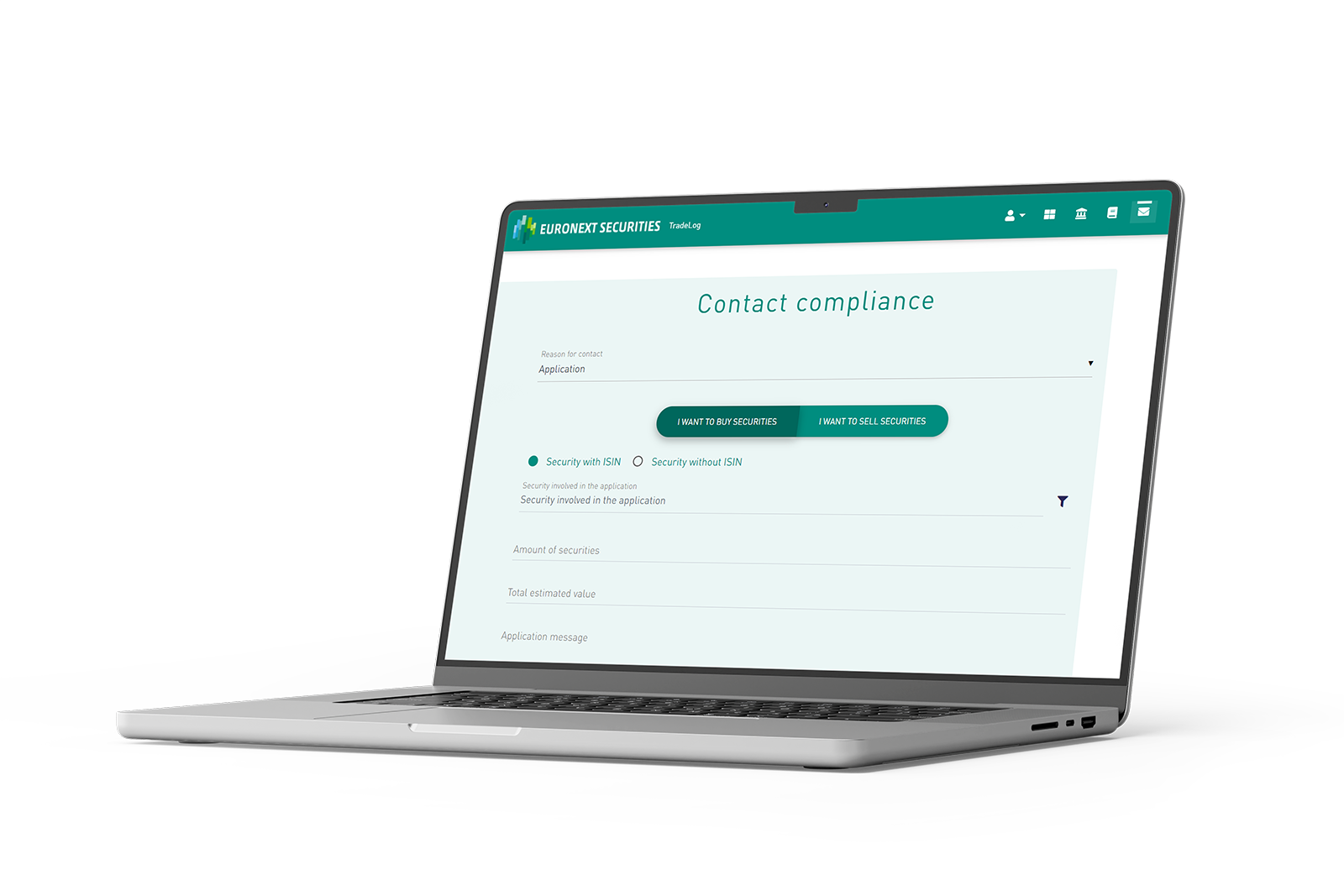

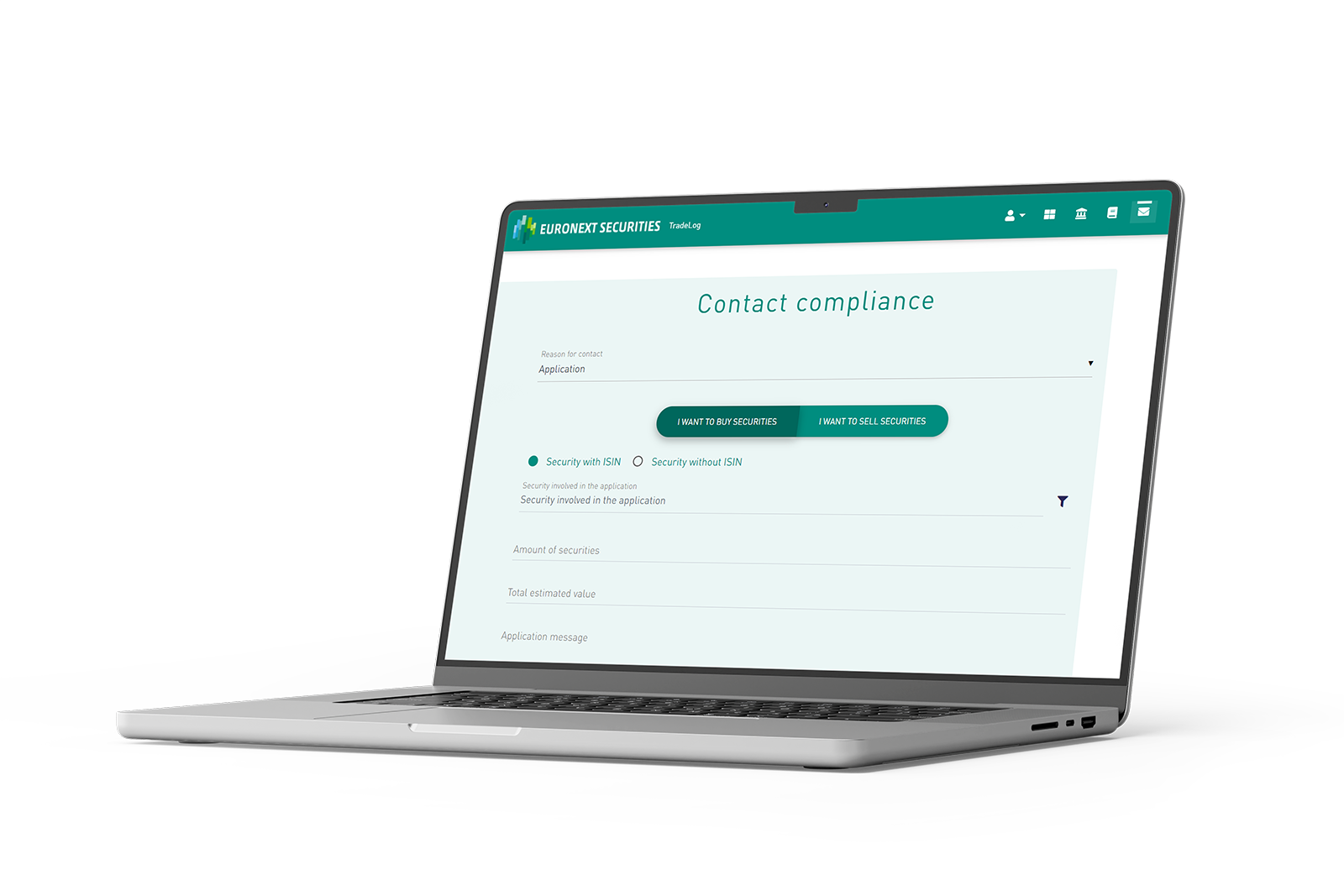

Online application

Automated pre-clearance

Record keeping and reporting

All our employees are required to register their securities holdings when they start working for us. Our previous solution required a great deal of manual work. Tradelog makes it easier for our Compliance team to get an overview of the holdings of a single employee or group of employees. The system was well-received amongst employees, primarily because employees feel the new system is simpler and more user-friendly than our previous one.

DNB MarketsFree up your compliance team

- Automatic personal trade monitoring where CSD connection is available

- Audit records and reports to authorities

- Built and hosted in the EU with complete GDPR compliance

- Log and overview of all employee personal trades and holdings

- Real-time violation alerts

Related resources

ebook

7 Compliance Risks of Employee Personal Trading

In this guide, you’ll learn what the Market Abuse Regulation (MAR) and MiFID II say about employee personal trading and why trade pre-clearance is an essential part of your compliance strategy. We provide clear, actionable steps to mitigate the risks associated with it.

Schedule

free demo

Discuss your requirements for personal trading compliance software and find out how TradeLog can help.