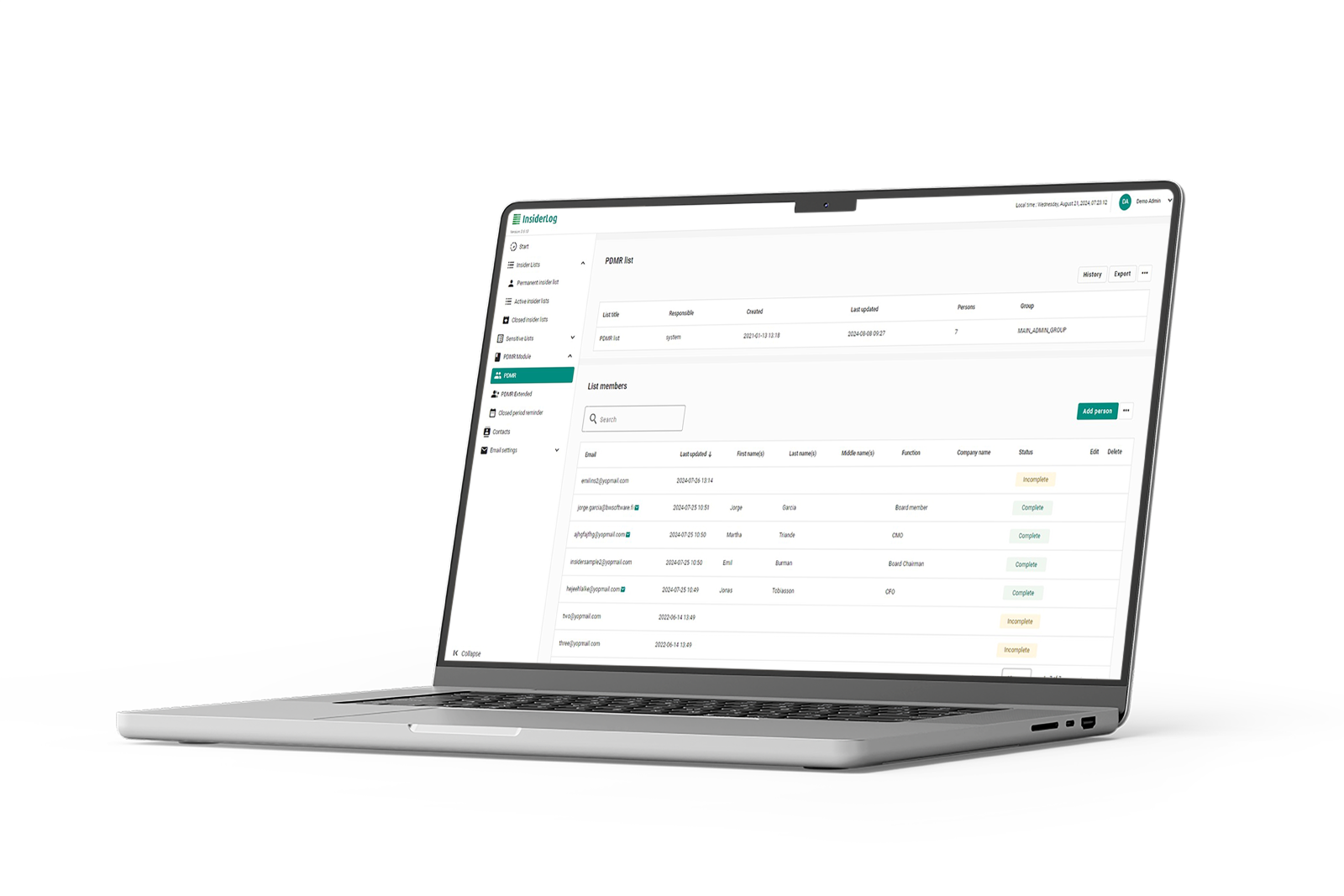

Speed up insider list management and reduce risk as an issuer

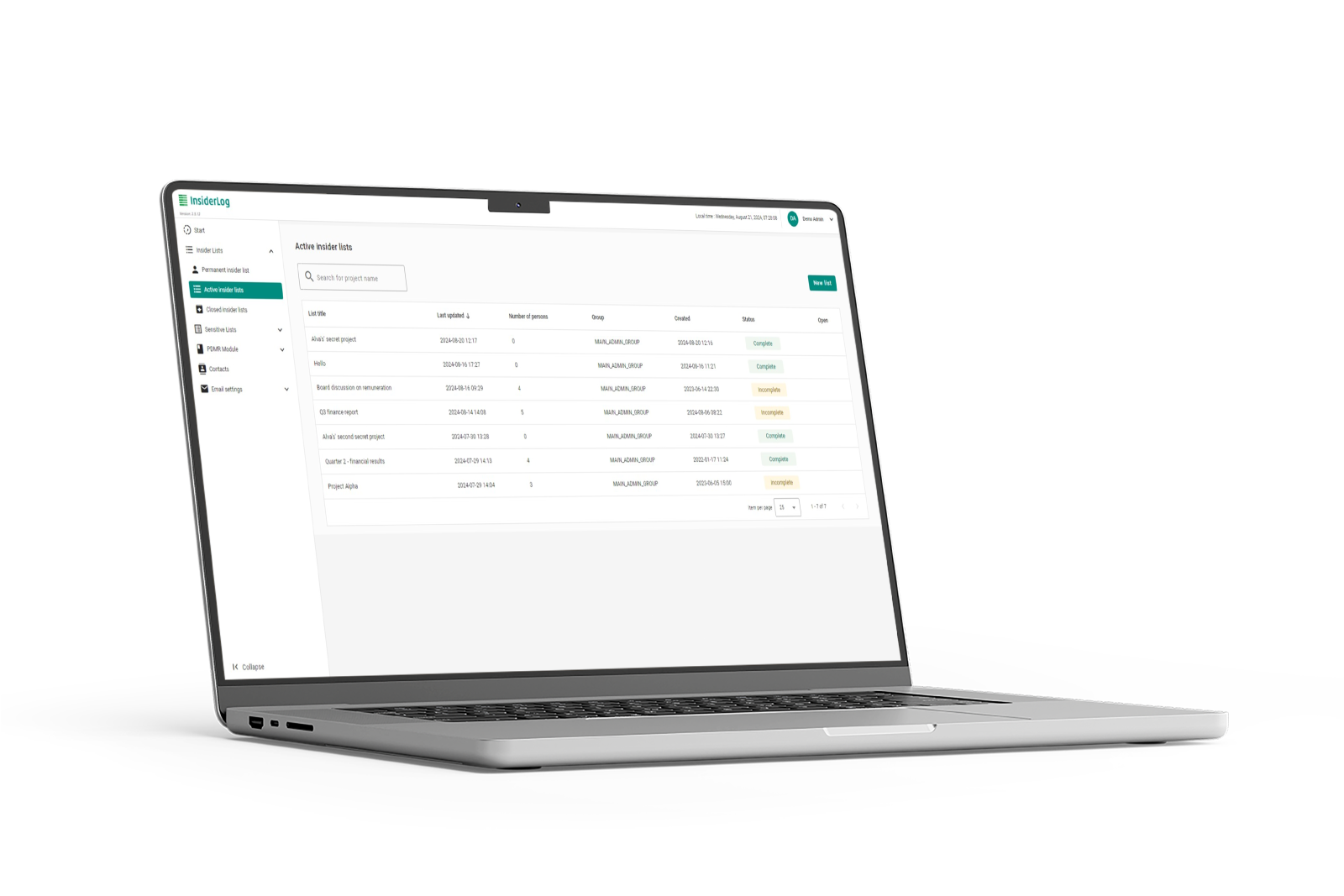

The manual administration of insider lists involves time-consuming, repetitive tasks. InsiderLog’s digital platform brings automation to your processes, helping you save valuable time and reduce the risk of non-compliance with the Market Abuse Regulation.

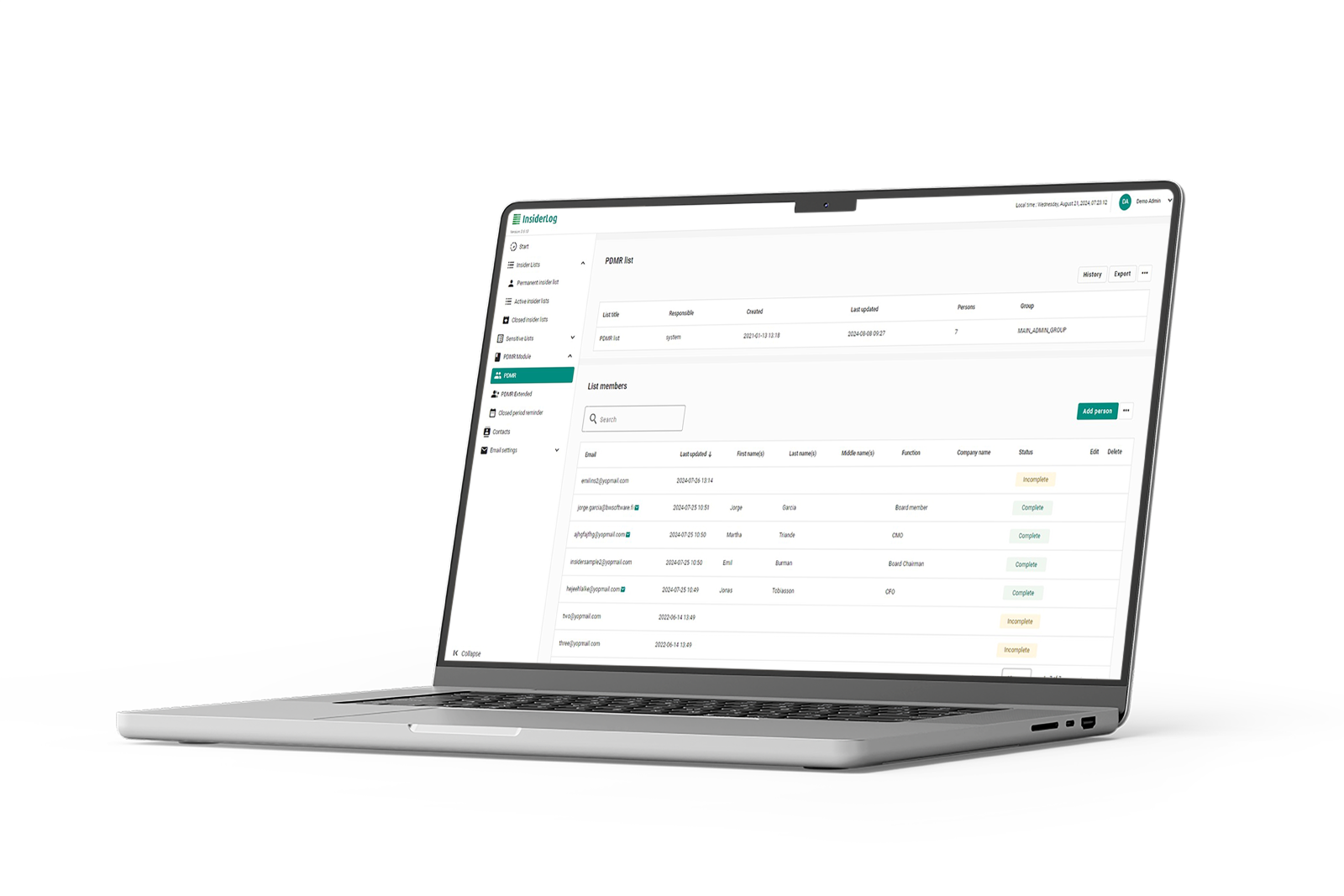

Effortlessly manage multiple clients and insider lists on one platform as an advisor

Advisory firms have to manage a number of insider, sensitive lists and market soundings across multiple clients. InsiderLog is insider list software designed to simplify this process and provide a clear overview of your insider information and lists while keeping a natural separation between client records.

InsiderLog is designed to fulfil the requirements of the European Market Abuse Regulation (MAR) while simplifying your compliance workflows.

Automate administration

From gathering data and notifying insiders of their obligations to versioning and reporting, InsiderLog handles the tedious tasks for you in a secure digital environment.

Minimise risk

InsiderLog automatically saves your lists in the correct ESMA format in order to help you to meet your obligations under both GDPR and MAR and prevent financial penalties.

Rely on expertise

Developed by legal experts and trusted by 1,000+ issuers and advisors, InsiderLog is built for purpose and is constantly updated to ensure compliance at all times.

Insider list management software with all the features needed for seamless MAR compliance

Insider & confidential lists

Data gathering & notifications

Versioning & audit trail

When integrating InsiderLog into our operations following our IPO, managing insider lists has been incredibly easy. The platform’s automated notifications and reporting capabilities ensure that we remain in full compliance with MAR. It has truly become essential for our regulatory processes, and we highly recommend it to any company looking to streamline their insider list management.

Gerrit De Vos, Group General Counsel and Chief Compliance Officer, Azelis Group (EBR: AZE)Future-proof your process

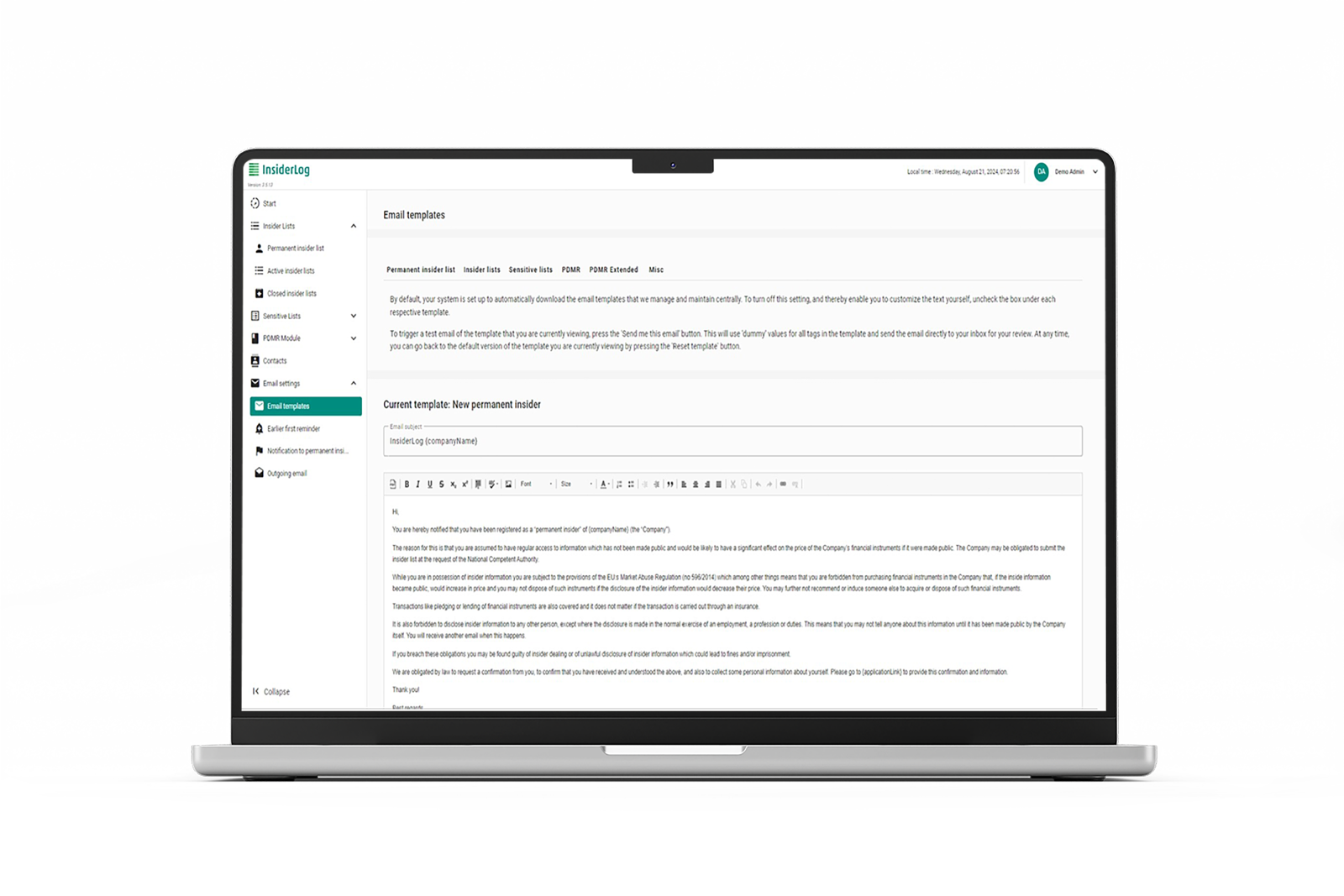

- Automated reminders with editable email templates

- Flexible, customisable forms to gather insider data

- Granular user management system

- UTC timestamps applied automatically

- Market sounding add-on module available

Related resources

guide

Issuers’ Guide to the Market Abuse Regulation

Dive into the Market Abuse Regulation and an issuer's obligation under the law. From managing insider lists and delaying the disclosure of inside information to identifying behaviours that count as market abuse, this guide provides you an in-depth understanding.

Schedule

free demo

Discuss your needs in relation to insider list management and find out how InsiderLog can help.